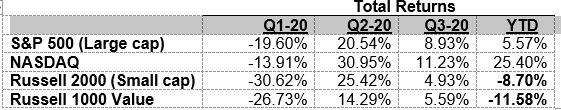

Market Recap – 3rd Quarter 2020

For equity markets, the third quarter was an extension of the first half of 2020. Large growth stocks - led by mega-cap tech issues - continued their dominance. Other sectors lagged, led by the poor performance of financial shares, as the Federal Reserve articulated policy that looks to keep interest rates at zero through 2023.

The broader economy did bounce back from the horrendous second quarter where GDP shrank by a record 31.4%! As the country reopened, the economy sharply rebounded - resulting in an estimated third-quarter growth of 30%.

Unfortunately, that still leaves the economy about 10% below prior levels, with a wide dispersion in outcomes for various industries. Consumer spending in areas such as restaurants, hospitality, and travel remains severely depressed, while housing, electronics, and durable goods are booming.

We expect that a combination of additional fiscal stimulus and progress on a vaccine/therapeutic will drive the economy to new highs in 2021. Absent either of these, the economy is likely to return to previous growth rates reaching new highs in GDP in late 2022.

The cyclical recovery has begun, and the mix of economic activity will gradually return to what we knew as normal. The consumer is in good shape - as measured by the savings rate and resulting balance sheet liquidity. Businesses have been able to reliquefy and are poised to invest as demand returns. Pent up demand for the sectors of the economy that are still depressed is building, and consumers and businesses can spend when confidence returns.

The prospects for companies that serve these markets look as good prospectively as they have in years, while absolute and relative valuations are at rock bottom levels.