New Year, New Review – January 2024

A new year is always a great time to review your financial goals. Having a plan to follow helps keep investors focused during times of market volatility. Being able to stay the course during good times or bad is half the battle to building long-term wealth. If you have not reviewed your financial picture recently, we encourage you to do so! We are always available for questions or to set up portfolio review meetings. Happy New Year!

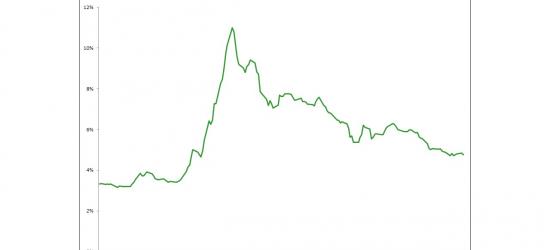

During the Federal Reserve (Fed) meeting on Wednesday, January 26, the Fed set expectations for a March 2022 interest rate increase. The Fed highlighted the strong labor market and inflation levels that are well above targets as reasons to begin…

On Wednesday, December 15, the Federal Reserve (Fed) announced it will accelerate the pace (tapering) of its monthly bond purchases. In November, the Fed announced it would begin reducing its purchases of Treasury bonds by $10 billion per month and…

On Wednesday, November 3, the Federal Reserve (Fed) announced it would begin slowing the pace (tapering) of its monthly bond purchases. Currently, the Fed is purchasing $120 billion a month of securities split between Treasury bonds ($80 billion)…

The upward trend in economically sensitive stocks paused during the third quarter. The market has had to come to grips with a resurgence in COVID-19 via the delta variant, uncertainty emanating from Washington D.C. surrounding fiscal spending and…

August 10, 2020 will go down in history as the first time a high yield, or junk bond, priced at under 3%.

Ball Corporation, rated one notch below investment grade by the rating agencies, was able to issue 10-year bonds at a yield of 2.85%. This…

For equity markets, the third quarter was an extension of the first half of 2020. Large growth stocks - led by mega-cap tech issues - continued their dominance. Other sectors lagged, led by the poor performance of financial shares, as the Federal…