Yield Curve Inversion Signals Heightened Volatility - 09/19

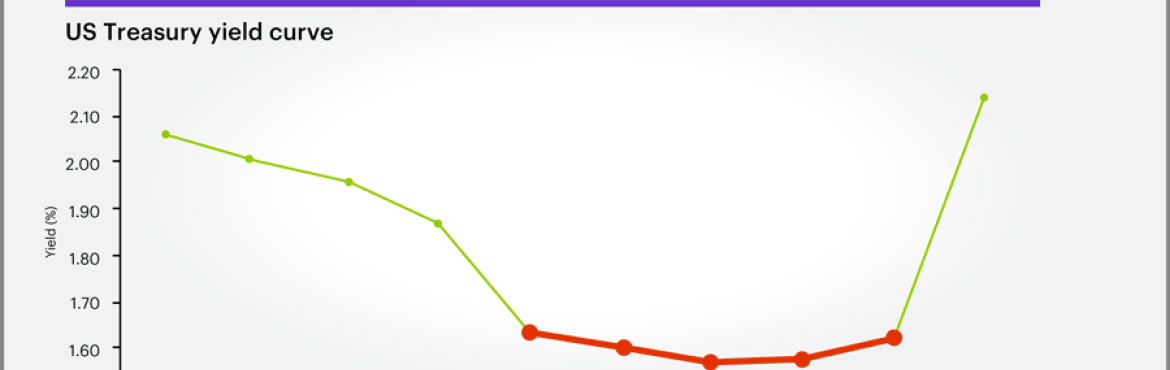

On Wednesday, August 14th broad stock market indices experienced a roughly 3% drop across the board – the worst day of 2019. Stocks sold off immediately at the opening bell and continued to worsen throughout the day. The reason: a growing sense of fear that a recession is looming. Specifically, 2-year and 10-year US Treasury yields inverted – meaning shorter duration bond yields exceeded long-duration bond yields – briefly in the morning for the first time since 2007. Historically an inverted yield curve has been a signal of an impending recession, which is the reason the market has tipped over so sharply, especially economically sensitive sectors like banks, industrials, materials, etc. The bond market, in general, is signaling economic distress with bonds being bid up and corresponding yields plummeting from north of 3% in late 2018 to near 1.6% for both 2-year and 10-year issuances. Stocks have just started to get the memo in the last three weeks since their recent peak.

Yesterday morning’s yield curve inversion, while worrisome, is not necessarily a rush-for-the-exits indicator. Markets typically see yield curve inversions last for months before recessions technically arrive. Also, following the first inversion, there generally has been roughly 15-20 months before a recession. The WSJ also reported on Thursday that since 1978 the S&P 500 has appreciated by an average of 13% from the first inversion until the next recession. Whether this inversion is the signal of a looming recession or not is anyone’s guess at this point. Some say that it is just a symptom of the entire market being distorted by the fact that $15 trillion of government debt around the world is trading at a negative yield – a tough concept to fully grasp for many people. That has made US bonds look increasingly attractive in 2019 as they have traded with a yield exceeding inflation. What has become clear, however, is that growth globally is slowing, and the US consumer is one of the few bright spots in the economic data. Volatility is likely here to stay so long as the data remains sluggish and the trade war with China lingers, and then in 2020, we’ll likely get another dose of volatility as the Presidential election draws near. So buckle up and maintain an asset allocation that can weather the volatility.