New Year, New Review – January 2024

A new year is always a great time to review your financial goals. Having a plan to follow helps keep investors focused during times of market volatility. Being able to stay the course during good times or bad is half the battle to building long-term wealth. If you have not reviewed your financial picture recently, we encourage you to do so! We are always available for questions or to set up portfolio review meetings. Happy New Year!

As we begin to get a peek at what 2020 might have in store for investors, we continue to see some encouraging signs in the economic data. Following a growth slowdown in the middle part of 2019 as the US-China trade war stifled businesses’…

There is an investing adage that says, “Don’t fight the Fed,” and has that adage ever proven true this cycle, but especially so in both 2018 and 2019. It’s been well documented that various rounds of so-called “Quantitative Easing” coming out of the…

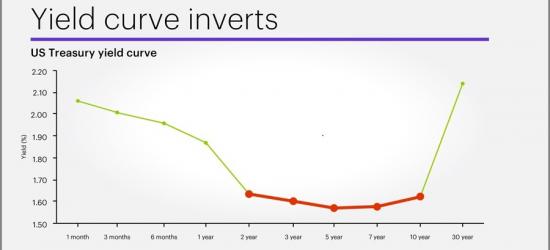

On Wednesday, August 14th broad stock market indices experienced a roughly 3% drop across the board – the worst day of 2019. Stocks sold off immediately at the opening bell and continued to worsen throughout the day. The reason: a growing sense of…

Just nine to twelve short months ago, interest rates were steadily climbing off the mat toward 3% and the path forward was on cruise control. The primary debate among informed market observers seemed to focus on whether 2019 would see three or four…

After sprinting to a 25% advance from the late December 2018 lows to a new high of 2945 on the S&P in early May, led again by the tech/growth complex, the market faded by ~5% in May. The culprit was a rapid escalation in trade tensions…

What a wild few months it’s been. Long gone are the calm, smooth waters of 2017. 2018 ended with a bang – or a crash! The dip in October as more rate hikes were foreshadowed was followed by a midterm election induced rally in November. Then the…